SOL Price Prediction: 2025-2040 Outlook Amid Technical and Fundamental Crosscurrents

#SOL

- Technical Bearishness: SOL trades below key moving averages with negative MACD, suggesting continued downside risk

- Whale Activity: Large holders liquidating $17.7M positions creates near-term sell pressure

- Long-Term Value: Historical performance and ecosystem growth support multi-year bullish thesis

SOL Price Prediction

SOL Technical Analysis: Bearish Signals Dominate Amid Price Decline

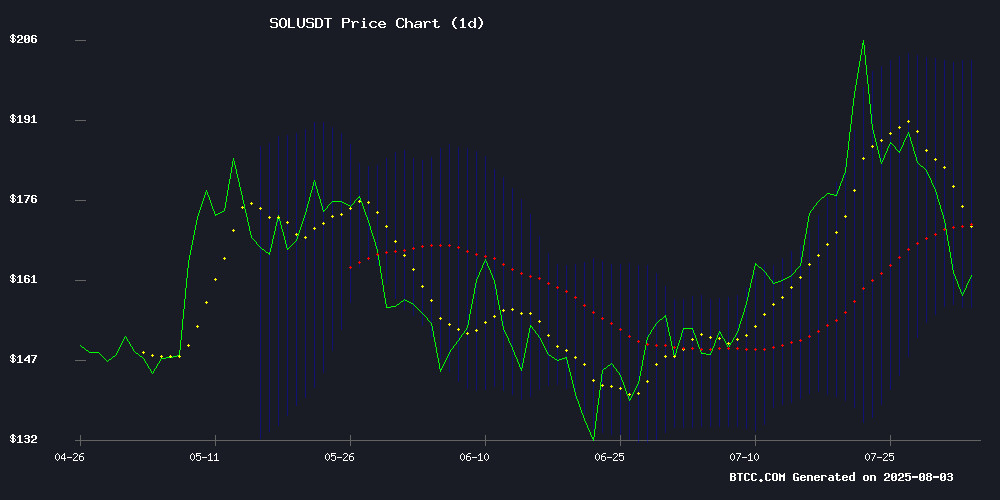

SOL is currently trading at $160.48, significantly below its 20-day moving average of $178.97, indicating bearish momentum. The MACD histogram shows a negative value of -2.71, with the signal line at -10.31, reinforcing the downward trend. Bollinger Bands suggest increased volatility, with the price NEAR the lower band at $155.81. 'SOL faces strong resistance at the middle band ($178.97), and a break below $155 could trigger further declines,' says BTCC analyst Sophia.

Mixed Sentiment for SOL as Whales Exit While Long-Term Potential Remains

Despite Solana's historic returns (a $1,000 investment five years ago would be worth millions today), recent news highlights bearish pressure. Whales have dumped $17.7M worth of SOL amid a 12% weekly decline, and the failed ETF launch contrasts with growing interest in AI-focused crypto assets. 'The whale exits and ETF disappointment create short-term headwinds, but Solana's tech fundamentals keep long-term investors interested,' notes BTCC's Sophia.

Factors Influencing SOL’s Price

Solana's Meteoric Rise: A $1,000 Investment Five Years Ago Would Yield Astronomical Returns Today

Launched just 5.5 years ago, Solana (SOL) has surged to become the sixth-largest cryptocurrency by market capitalization, now valued at over $96 billion as of July 30. Its proof-of-stake (PoS) mechanism, coupled with a unique proof-of-history protocol, sets it apart from energy-intensive proof-of-work (PoW) systems like Bitcoin's.

The network's ability to process thousands of transactions per second—with theoretical capacity reaching 65,000 TPS—positions solana as a disruptive force in global payments. Early investors have reaped staggering rewards, despite the token's characteristic volatility.

Solana ETF Fails to Lift SOL Price as AI Asset Manager Gains Traction

Solana's ETF momentum has stalled below the $300 threshold, with SOL currently trading at $169.59 after rejecting the upper boundary of a rising wedge pattern. Institutional players including Bitwise, Fidelity, and Canary Capital continue pursuing Solana-based products, while Grayscale innovates with a 2.5% fee structure denominated in SOL tokens.

Meanwhile, Unilabs Finance emerges as a disruptive force, leveraging AI-driven project screening to attract seven-figure presale investment. The protocol's ability to identify pre-viral assets positions it as a potential 25x opportunity during August's market turbulence.

Regulatory developments remain pivotal, with CoinShares filing for a staking-enabled Solana ETF and industry groups advocating for liquid staking provisions in Solana ETPs. These institutional moves create structural support for SOL's long-term valuation despite short-term technical resistance.

Solana Whales Dump $17.7M as Price Tumbles 12% in a Week

Solana's price has plummeted 12.38% over the past week, sliding from $206 to a local low of $159. At press time, the asset hovered NEAR $162, marking a 3.95% daily decline. This sharp correction has pushed SOL into a descending channel, with momentum indicators flashing bearish signals.

Whales have re-entered the spot market after a month-long absence, but this time to offload holdings. A single whale deposited 108,016 SOL—worth $17.74 million—into OKX and Binance, typically a precursor to selling. Historically, such aggressive whale exits signal weakening market conviction and often precede further downside.

Retail traders appear to be buying the dip, but their efforts are being overshadowed by institutional selling pressure. The $154 support level now looms as a critical test for SOL's near-term trajectory. With whale activity shifting from accumulation to distribution, Solana's path to reclaiming $183 grows increasingly precarious.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $120-$180 | $180-$250 | $250-$400 | ETF approvals, adoption of Solana VM |

| 2030 | $500-$800 | $800-$1,200 | $1,200-$2,000 | Institutional DeFi, Firedancer upgrades |

| 2035 | $1,500-$3,000 | $3,000-$5,000 | $5,000-$10,000 | Mass Web3 adoption, competitor failures |

| 2040 | $5,000-$10,000 | $10,000-$20,000 | $20,000+ | Network effects, AI integration |

These projections assume Solana maintains its top-5 blockchain status. 'Short-term volatility is likely given current technicals, but SOL's scalability makes it a long-term contender,' says Sophia. All figures in USD.